Uncovering real-life experiences through title loan customer testimonials reveals a valuable resource in today's digital age. Customers praise the accessibility, convenience, and targeted financial support of title loans, particularly for semi truck loans, highlighting friendly staff, straightforward processes, and prompt funding. These testimonials address concerns about credit checks, emphasizing that these loans value vehicle assets over extensive credit history. Title loan customer testimonials provide a much-needed solution for borrowers seeking quick cash, allowing individuals to access funds using their vehicle's equity while retaining full use of the vehicle during the loan period.

“Uncover the real-life stories behind title loan customer testimonials—a powerful resource for understanding the true value of these financial tools. From struggling individuals to those in need of quick cash, this article delves into the diverse experiences and impacts of title loans. We explore how these short-term financing options have helped borrowers manage unexpected expenses and overcome financial hurdles. By shedding light on both positive and (if present) negative testimonials, we aim to debunk myths and empower readers with informed insights.”

- Uncovering Real-Life Experiences: A Look at Title Loan Customer Testimonials

- The Impact and Benefits: How Title Loans Have Affected Borrowers' Lives

- Debunking Myths: Why Title Loan Customer Testimonials Are a Reliable Resource

Uncovering Real-Life Experiences: A Look at Title Loan Customer Testimonials

Uncovering Real-Life Experiences: A Look at Title Loan Customer Testimonials

In today’s digital age, when making financial decisions, it’s crucial to hear from people who have walked a similar path. Title loan customer testimonials offer a unique glimpse into real-life experiences that can be invaluable for prospective borrowers. These stories not only highlight the accessibility and convenience of title loans but also reveal how these short-term financing options can help bridge immediate financial gaps.

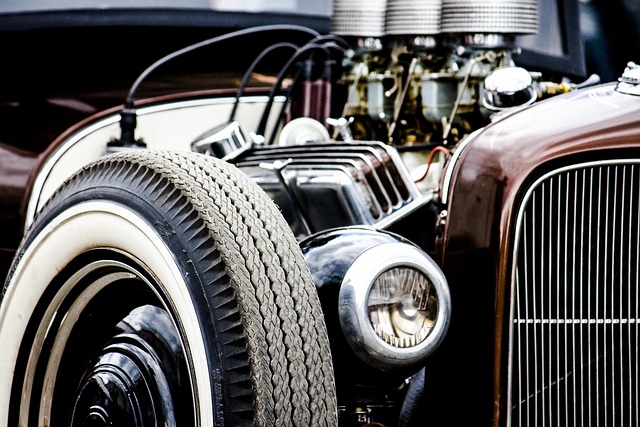

Many customers share their positive encounters with friendly staff, straightforward processes, and prompt funding, especially when it comes to semi truck loans or other specialized needs. Moreover, while some may have concerns about credit checks, testimonials often emphasize that these loans are more focused on the value of the vehicle than on extensive credit history, making them an attractive option for those with less-than-perfect credit.

The Impact and Benefits: How Title Loans Have Affected Borrowers' Lives

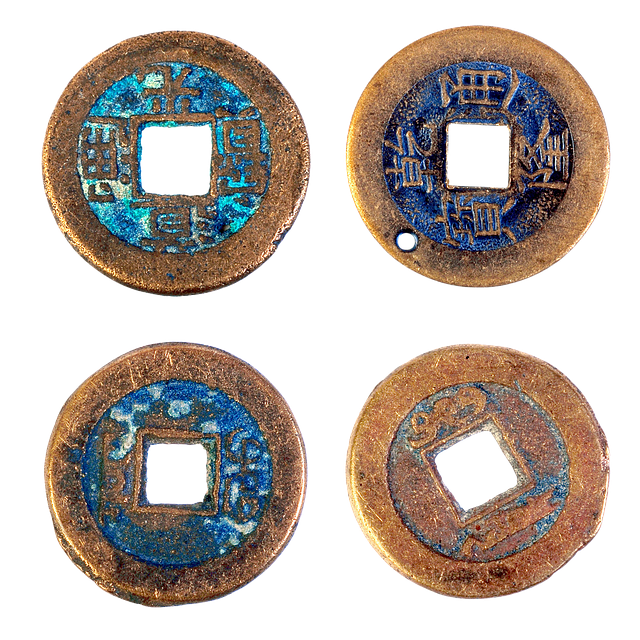

Many borrowers turn to Title Loans as a solution for their financial needs, and the positive impact on their lives is evident through customer testimonials. These loans provide a unique opportunity for individuals to access quick cash using the equity in their vehicles. For those facing unexpected expenses or seeking relief from debt, Dallas Title Loans can be a game-changer.

The benefits are clear: an online application process that is simple and convenient, allowing borrowers to apply from the comfort of their homes; loan eligibility based on vehicle value, making it accessible to a wide range of individuals; and most importantly, the ability to retain full use of your vehicle during the loan period. These loans offer a sense of security and flexibility, enabling borrowers to manage their finances effectively and make headway towards their financial goals.

Debunking Myths: Why Title Loan Customer Testimonials Are a Reliable Resource

Many people approach title loans with caution, often due to misconceptions and lack of understanding. One common myth is that these loans are exploitative or that customer testimonials are fabricated. However, the truth lies in the real-life experiences shared by satisfied borrowers. Title loan customer testimonials serve as a powerful tool to dispel these myths and offer valuable insights into why this type of lending has gained popularity.

These testimonials provide firsthand accounts of how title loans have helped individuals during financial emergencies. By sharing their stories, borrowers highlight the transparent process, fair vehicle valuation, and convenient vehicle inspection procedures. Moreover, they emphasize that keeping your vehicle is a significant advantage, ensuring that even with a loan, you retain possession, which isn’t always the case with traditional secured loans.

Title loan customer testimonials serve as powerful tools for understanding the real-world impact of these financial services. By sharing their experiences, borrowers highlight not only the convenience and accessibility of title loans but also the tangible benefits they bring to individuals facing various financial challenges. Debunking myths through these authentic narratives emphasizes the reliability and value of title loan customer testimonials as a resource for those seeking transparent information in making informed decisions.