Title loan customer testimonials are vital for borrowers seeking reliable financing secured by their vehicles. These real-life accounts influence decisions by revealing lender reliability, transparency, approval speed, interest rates, and customer service. Positive testimonials attract borrowers with competitive terms, while negative ones deter them, showcasing the significant impact on financial choices.

Title loan customer testimonials are more than just words; they are powerful tools that shape borrowers’ financial journeys. This article delves into the profound impact these testimonials have on individuals seeking short-term funding. By exploring real stories, we uncover how borrower experiences influence decisions, fostering trust and providing insights into the reliability of title loan services. Understanding this dynamic is key to navigating the financial landscape with confidence.

- Understanding the Impact of Testimonials on Borrowers

- Building Trust: How Testimonials Influence Decisions

- Real Stories: The Power of Customer Experiences Shared

Understanding the Impact of Testimonials on Borrowers

In today’s digital age, where online reviews carry significant weight, title loan customer testimonials play a pivotal role in shaping borrowers’ decisions. These real-life experiences and feedback from peers offer invaluable insights into the lending process, particularly within the niche of title loans secured by vehicle collateral. Borrowers often turn to these testimonials to gauge the reliability and transparency of lenders, especially when dealing with urgent financial needs.

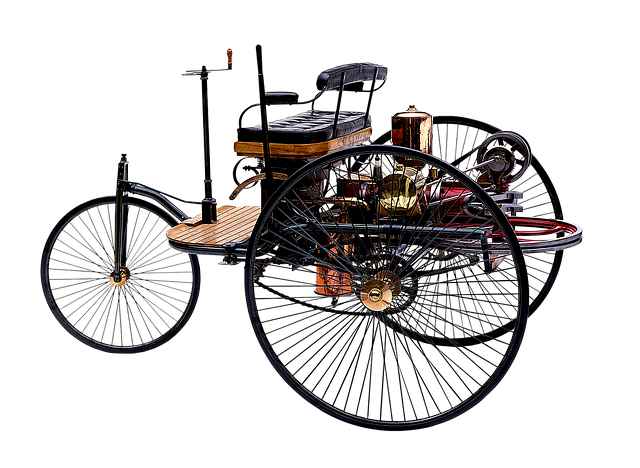

A borrower’s journey with a title loan begins with a quest for quick approval and favorable loan terms. Testimonials act as a compass, guiding them towards reputable lenders who honor their promises. Positive reviews about efficient approval processes, competitive interest rates, and flexible repayment options can significantly influence a borrower’s perception of a lender. Conversely, negative testimonials highlighting hidden fees, stringent terms, or less-than-satisfactory customer service can deter potential borrowers, emphasizing the power these words hold in the financial decision-making process.

Building Trust: How Testimonials Influence Decisions

When prospective borrowers look for a title loan, they often turn to customer testimonials as a crucial source of information. These firsthand accounts from satisfied customers can significantly influence their decisions. Testimonials build trust by offering a glimpse into the experience of others, providing evidence of a lender’s reliability and integrity. Borrowers can feel more assured knowing that other vehicle ownership individuals have successfully navigated the loan requirements and found favorable terms.

This social proof is particularly valuable when considering a financial decision with potential implications on loan eligibility. By reading about how transparent communication, fair practices, and accessible services have benefited others, borrowers are more likely to trust that they too will receive a positive experience. As a result, title loan customer testimonials play a pivotal role in shaping the perception of lenders and can even act as a game-changer in attracting new clients.

Real Stories: The Power of Customer Experiences Shared

When it comes to making decisions about borrowing money, especially through non-traditional means like Boat Title Loans or Car Title Loans, real stories and experiences shared by fellow borrowers carry significant weight. Title loan customer testimonials offer a glimpse into the actual lives of individuals who have availed these financial services, providing valuable insights into their journey. These narratives are powerful because they humanize a process that can often seem daunting or mysterious to those unfamiliar with it.

By reading about others’ positive experiences with flexible payments and tailored solutions offered by title loan providers, prospective borrowers gain a better understanding of what to expect. Such testimonials build trust, assuring individuals that these loans are accessible and potentially life-saving options for unexpected financial needs. They also highlight the importance of responsible borrowing and how transparent communication can make a significant difference in one’s financial well-being.

Title loan customer testimonials play a pivotal role in shaping borrowers’ experiences and decisions. By understanding the impact of these testimonials on building trust, we gain insight into why real stories shared by satisfied customers are so powerful. These testimonials not only enhance transparency but also serve as a reliable guide for those considering a title loan, ultimately fostering a more trustworthy lending environment.